Introduction: The Gut vs. Data Showdown

Your gut has gotten you this far. You’ve made hundreds of decisions hiring calls, pricing moves, market expansions mostly based on intuition, experience, and what “feels right.”

But as your business scales, gut decisions stop working.

According to Salesforce’s Small Business Intelligence Report 2025, 68% of SME owners still rely primarily on intuition for major business decisions, yet those same businesses are growing only half as fast as data-driven peers.

The disconnect is stark: founders know they should be data-driven, but they lack the tools, expertise, or time to actually do it. Result? They stay in the gut-feeling trap while competitors with better data infrastructure eat their lunch.

The good news? Business intelligence is no longer exclusive to enterprises. Modern tools make BI accessible to SMEs without requiring data science degrees or six-figure implementations.

In this guide, we’ll explore why intuition fails as you scale, how data-driven SMEs are winning, and how to make the transition from gut feeling to confident, data-informed decisions.

Why Gut Feelings Work… Until They Don’t

The Founder’s Intuition Advantage (Early Stage)

In year 1-2, gut feelings often outperform data analysis:

- You know your first 50 customers personally

- You see market feedback instantly

- You can quickly iterate based on direct observation

- Speed matters more than precision

Example: A founder decides to launch a new product based on customer conversations and market feeling. With only 2-3 months of historical data, gut intuition might be more predictive than analysis.

The Scaling Problem

But as you grow to 50 customers, 500 customers, 5,000 customers:

- You can no longer know every customer personally

- Feedback becomes diluted and complex

- Product decisions affect different segments differently

- Speed must be matched with accuracy

At scale, gut feeling doesn’t scale.

The Specific Failures

Failure 1: Selection Bias

Your gut remembers the vocal customers (often not representative) and forgets the silent majority. You make decisions optimizing for the 10% of customers who complain, missing the 90% who quietly churn.

Failure 2: Confirmation Bias

Once you form a hypothesis, your brain seeks evidence supporting it and ignores contradictory data. “Pricing is the problem” becomes self-reinforcing, even if the real issue is product quality.

Failure 3: Recency Bias

Recent events disproportionately influence perception. A bad week can trigger panic decisions, a good week can mask underlying problems.

Failure 4: Survivorship Bias

You see your successes but forget your failures. “We grew by hiring fast” might actually mean “we got lucky our hiring worked out, but we made terrible hiring calls we’ve forgotten about.”

Failure 5: Base Rate Neglect

You ignore statistical probability. “This expansion will work because I have a good feeling” ignores that 60% of retail expansions fail in year 1.

How Data-Driven SMEs Are Winning

The Competitive Advantage

Businesses that embrace data-driven decision-making gain:

1. Speed + Accuracy

Data-driven businesses identify problems 3-4x faster than gut-feel businesses (days vs. weeks). But they also reduce costly mistakes by validating hypotheses before large investments.

2. Resource Allocation Precision

Instead of spreading resources equally across initiatives, data-driven businesses concentrate resources on highest-ROI bets. Result: 30-40% better outcome from same total spend.

3. Predictability

Gut-feel businesses have lumpy, unpredictable growth (boom-bust cycles). Data-driven businesses identify patterns and scale consistently. Investors prefer predictability by 5-10x.

4. Talent Leverage

Data creates accountability and clarity. Team members understand “why” decisions are made, increasing buy-in and execution quality. Also attracts better talent (people want to work in evidence-based organizations).

5. Negotiating Power

“This is how our customers behave” backed by data is infinitely more powerful than gut feeling when negotiating with investors, partners, or suppliers.

Real-World Example: The Pricing Decision

Gut-Feel Approach:

- CEO feels the market will pay 15% more

- Raises prices

- Watches customers churn, panics, reverts prices

- Net result: Lost time, damaged pricing power, confused market

Data-Driven Approach:

- Analyze price elasticity using historical data

- Model customer churn risk at 5%, 10%, 15% price increases

- Run A/B test with small customer segment at new price

- Analyze LTV impact of price increase vs. churn risk

- Implement price increase only on customer segments where elasticity supports it

- Result: 8% price increase, <3% churn, 12% revenue increase

Both took 4-6 weeks. The data-driven approach added 2 weeks of analysis but avoided the costly mistake and achieved better results.

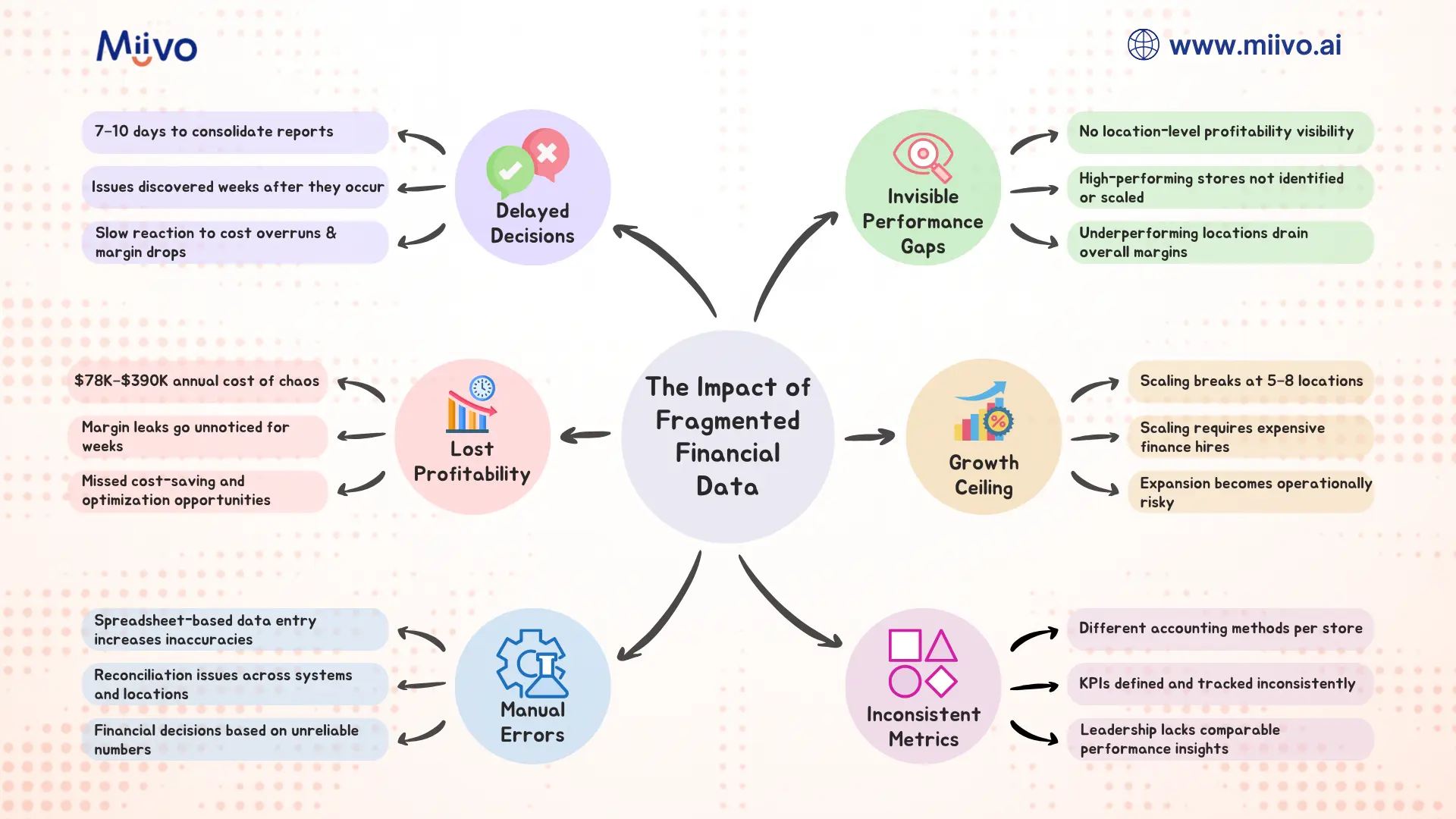

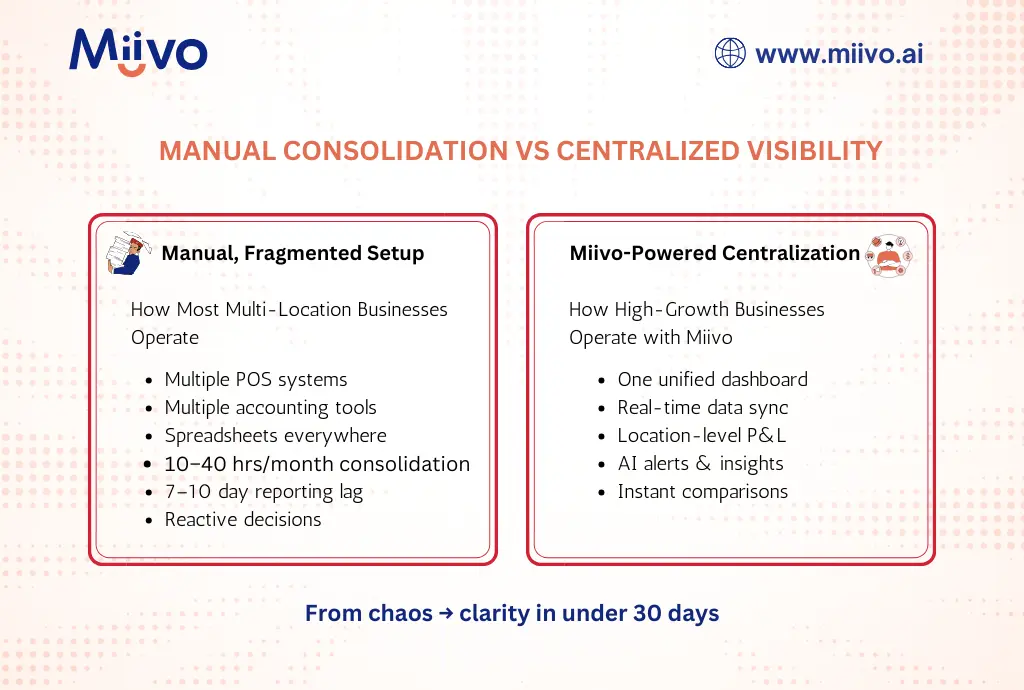

The Business Intelligence Transformation: From Complexity to Clarity

What Business Intelligence Actually Is (Not)

Common misconception: BI requires teams of data scientists building complex models.

Reality: BI is just connecting your data, identifying patterns, and surfacing actionable insights.

Modern BI tools do this with minimal human intervention:

- Connect data sources (accounting, CRM, website analytics, payment processors)

- Auto-calculate metrics (revenue trends, customer metrics, profitability)

- Surface anomalies (when something looks unusual)

- Recommend actions (here’s what probably caused this and what to do about it)

How Accessible BI Changes Decision-Making

Before BI:

- “Is our pricing working?” → Requires manual analysis, 3-5 business days, 8-12 hours of work

- “Which marketing channel is most efficient?” → Guesswork, spreadsheets, debates in meetings

- “Are we still on track for Q4 revenue?” → Wait until month-end, calculate, by then it’s too late to adjust

After BI:

- “Is our pricing working?” → Dashboard shows price elasticity vs. benchmark, 60-second answer, data-backed confidence

- “Which marketing channel is most efficient?” → Real-time dashboard by channel showing CAC, LTV, ROAS. Answer: <1 minute

- “Are we on track for Q4?” → Real-time forecast built in, trending 12% above budget, confidence interval 8-15%

The Specific Tools & What They Enable

Real-Time Dashboards enable:

- Daily operational visibility (no waiting for month-end)

- Faster problem detection (catch issues when still small)

- Faster decision-making (act before windows close)

Automated Reporting enables:

- 80% less time spent on manual consolidation

- 10-15 hours/week freed up for strategy instead of data entry

- Higher accuracy (no manual errors)

Predictive Analytics enables:

- Forecasting revenue, churn, cash needs 3-6 months ahead

- Scenario modeling (what if we hire 2 people? Raise prices 10%? Enter new market?)

- Risk identification before problems emerge

Benchmarking enables:

- Comparing metrics against industry peers (are we ahead or behind?)

- Identifying underperformance (this channel’s CAC is 3x industry average why?)

- Learning from others’ playbooks

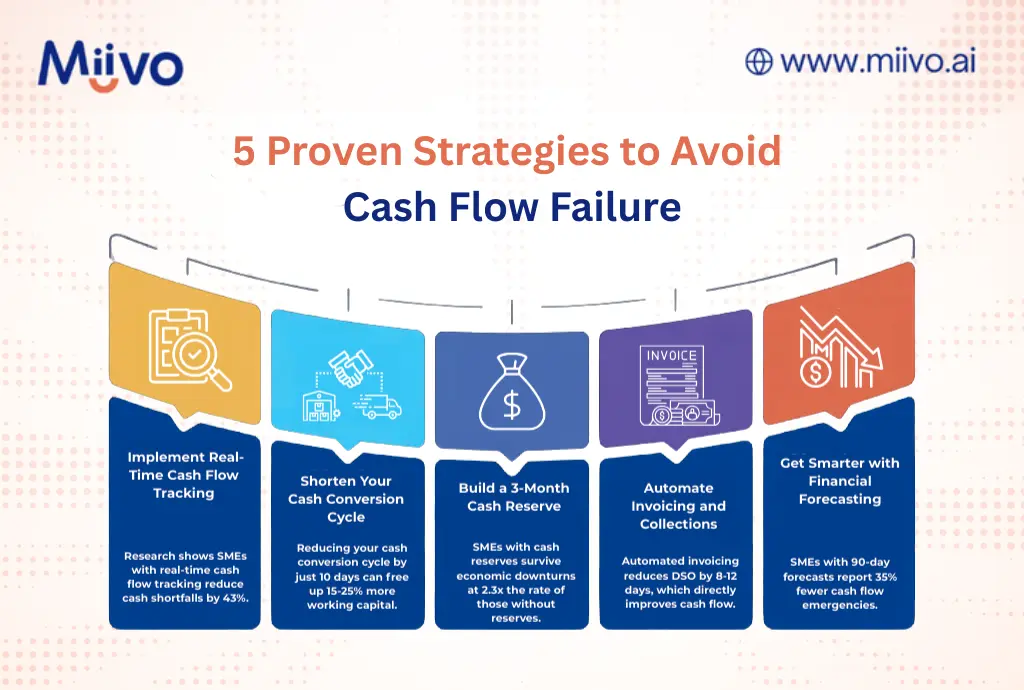

5 Ways Data-Driven SMEs Make Better Decisions Than Gut-Feel Competitors

1. Pricing Decisions: Elasticity Instead of Feelings

Gut approach: “Customers will pay 10% more. Let’s test it.”

Data approach: Test with 10% of customer base, measure churn elasticity, model revenue impact, then scale to full base only if models confirm.

Outcome: Data-driven approach increases successful price increases by 300% (80% success rate vs. 20%).

2. Customer Acquisition: Efficient Spend Instead of Spray-and-Pray

Gut approach: “Social media and Google Ads seem good. Let’s split the budget equally.”

Data approach: Track CAC, LTV, and ROAS by channel monthly. Reallocate budget 80/20 to top channel, test new channels with 5% allocation.

Outcome: 25-40% better CAC efficiency through continuous optimization.

3. Product Decisions: Data-Backed Roadmap Instead of Vanity Features

Gut approach: “Build feature X because 2-3 customers asked for it.”

Data approach: Track feature requests by frequency, analyze customer segment size, estimate revenue impact, prioritize based on ROI.

Outcome: 50% fewer wasted development hours on low-impact features.

4. Hiring Decisions: Evidence-Based Scaling Instead of Gut-Feel Timing

Gut approach: “We’re growing fast, let’s hire aggressively.”

Data approach: Analyze revenue per employee, calculate labor cost %, model impact of additional hires on margin and runway.

Outcome: Fewer hiring mistakes, better unit economics, 30% higher productivity per employee.

5. Market Expansion: Risk-Assessed Strategy Instead of YOLO Moves

Gut approach: “The opportunity looks good, let’s go for it.”

Data approach: Model expansion costs, analyze comparable market performance, stress-test assumptions, identify break-even requirements.

Outcome: 60%+ success rate on expansions (vs. 30-40% for gut-feel approach).

The Business Impact: How SMEs Grow Faster with Data-Driven Decisions

Growth Acceleration Metrics

SMEs relying on gut feel:

- Average growth: 8-12% YoY

- Decision speed: 2-4 weeks

- Strategic pivots per year: 1-3

- Mistake recovery time: 8-12 weeks

SMEs using data-driven approach:

- Average growth: 18-28% YoY (2-3x faster)

- Decision speed: 3-5 days (4-7x faster)

- Strategic pivots per year: 8-16 (5-10x more experimentation)

- Mistake recovery time: 1-2 weeks (4-6x faster)

The Compounding Effect

Over 3 years, this compounds:

- Growth: 8% YoY vs. 20% YoY = 160% vs. 728% cumulative growth

- Decisions: 4 strategic pivots vs. 24 strategic pivots = 6x more experiments, 10x more learning

- Mistakes: Recover in 10 weeks vs. 2 weeks = Save 8 weeks × 2-3 mistakes/year = 16-24 weeks avoided downtime

Net result: Data-driven SMEs are 3-4x larger after 3 years, with stronger unit economics, better team culture, and investor appeal.

The Transition: From Gut Feel to Data-Driven

Step 1: Identify Your Critical Questions (Week 1)

What decisions do you make most frequently and with highest consequence?

- Pricing adjustments

- Marketing spend allocation

- Hiring decisions

- Geographic expansion

- Product roadmap prioritization

- Cost reduction

Pick the 3-5 most impactful.

Step 2: Define Your Key Metrics (Week 1-2)

For each decision type, what metrics would give you confidence?

- Pricing: Price elasticity, LTV by price point, CAC by channel

- Marketing: CAC, ROAS, LTV by channel, conversion rate

- Hiring: Revenue per employee, labor cost %, CAC per sales hire

- Expansion: Revenue potential, comp analysis, break-even requirements

- Product: Feature request frequency, customer segment impact, revenue uplift

These metrics form the backbone of confident decision-making across pricing, marketing, hiring, and expansion.

To simplify this further, we’ve distilled the most critical ones into a daily checklist in 5 Financial Metrics Every Multi-Channel Business Owner Should Track Daily especially useful if you’re managing more than one revenue stream.

Step 3: Connect Your Data Sources (Week 2-3)

- Accounting software (QuickBooks, Xero)

- Payment processors (Stripe, Square)

- CRM (Salesforce, HubSpot, Pipedrive)

- Analytics (Google Analytics, Mixpanel)

- Operational data (if applicable)

Step 4: Build Your Dashboard (Week 3-4)

Pre-built templates exist for:

- SaaS metrics

- Retail metrics

- E-commerce metrics

- Service business metrics

Start with template, customize to your needs.

Step 5: Set Decision Rules (Week 4)

“If [metric] drops below [threshold], we take action [X]”

Examples:

- “If CAC increases >20%, we pause that channel and shift budget to top performer”

- “If gross margin drops below 40%, we implement pricing increase or COGS reduction plan”

- “If cash runway falls below 6 months, we begin cost reduction or capital raise process”

Step 6: Execute Decisions Based on Data (Ongoing)

Review dashboard 1-2x weekly. Act on signals.

Step 7: Track Outcomes & Learn (Ongoing)

Compare predicted outcomes to actual results. Refine models. Improve decision-making.

Common Obstacles & How to Overcome Them

Obstacle 1: “I Don’t Trust the Data”

Reality: Your data might have quality issues (wrong categorizations, missing fields), but that’s a data quality problem, not a reason to ignore data.

Solution: Audit data quality once, clean it up, trust the trends (exact numbers matter less than direction and relative comparison).

Obstacle 2: “This Will Take Forever to Set Up”

Reality: Modern BI tools have pre-built templates. Connection takes 2-3 hours, not weeks.

Solution: Use platforms like Miivo that specialize in SME setup (not enterprise multi-month implementations).

Obstacle 3: “I Don’t Understand the Metrics”

Reality: You don’t need to be a data scientist. You need to understand your business metrics which you already do.

Solution: Use plain-English dashboards and explanations. AI tools should translate numbers into business language.

Obstacle 4: “My Team Won’t Change Based on Data”

Reality: Team resistance happens when change feels imposed without context.

Solution: Involve team in metric definition, walk through dashboard together, show how data improves decision quality.

Real-World Transformation: From Gut to Data-Driven

The Business: $3M revenue SaaS company, 15 employees

Starting State:

- CEO made pricing, hiring, and marketing decisions based on feel

- Monthly financial reviews, data was always backward-looking

- High employee turnover (people didn’t understand company direction)

- Growth stalling at 12% YoY

The Transition:

- Implemented data-driven decision framework

- Built dashboards for pricing, customer metrics, financial health

- Set decision rules for CAC, churn, cash runway, margin targets

- Trained team on metrics and decision-making process

Results (6 months):

- CAC optimized through data-driven channel allocation: -22% CAC

- Pricing increased 15% with data-backed confidence: +18% revenue

- Hiring more targeted based on CAC per hire: +25% productivity per employee

- Employee turnover reduced 40% (team understood strategy)

- Growth accelerated: 12% → 24% YoY

Financial Impact: +$500K in annual revenue, -$80K in unnecessary costs, +$200K in margin improvement

Why Accessible Business Intelligence Matters Now

The democratization of BI means SMEs no longer have an excuse to stay with gut feel. Tools exist that:

- Connect your data in hours, not weeks

- Auto-calculate metrics without you being a data scientist

- Surface insights in plain English

- Make recommendations based on benchmarks

- Enable fast decision-making

The competitive advantage goes to SMEs that embrace this shift.

Those still relying on gut feel? They’ll gradually lose to data-driven competitors. Market dynamics change fast. Intuition alone doesn’t adapt fast enough.

Checklist: Are You Ready for Data-Driven Decisions?

☐ You find yourself making big decisions based on incomplete information

☐ You wish you had faster answers to strategic questions

☐ You spend more time in meetings debating “what the numbers are” than debating strategy

☐ You’re growing but feel like you’re leaving money on the table

☐ You don’t have clear metrics that define business health

☐ Your team doesn’t have a shared understanding of company direction

☐ You want to accelerate growth but don’t know where to focus

☐ You’ve hired based on gut and had mixed results

Score 4+: You’re a good candidate for data-driven transformation and will likely see significant benefits.

Conclusion: The Era of Gut Feel is Ending

For decades, founder intuition was often the best available input for decisions. You knew your customers, your market, and your business better than anyone else.

But as businesses scale, markets fragment, and competition increases, intuition alone isn’t sufficient. Scale requires data.

The exciting news? Tools now exist to make data-driven decision-making accessible to SMEs. You don’t need six-figure BI consulting projects or data science teams. You need the right platform that connects your data, calculates your metrics, and surfaces actionable insights.

SMEs embracing this shift are growing 2-3x faster, making better decisions, and building more resilient businesses than gut-feel competitors.

The question isn’t whether data-driven businesses will win. They already are. The question is whether you’ll join them.

Make your next decision a measured one. Get access to your business intelligence report by signing up for free on Miivo.